Between anode and cathode: the future

The transformation has long begun. To counteract the impact of climate change as effectively as possible, greenhouse gas emissions must be radically reduced on a global scale. In that regard, one of the focus areas is the decarbonization of transportation because cars, trucks, ships and aircraft are still massively emitting CO₂.

A key technology on the road toward climate-compatible and resource-conserving mobility is the electric powertrain. Major automakers are now offering a wide range of electric vehicles. The goal is ambitious: by 2030, 15 million fully electric vehicles are supposed to be registered in Germany alone, according to the federal government’s plan. Worldwide, they’re supposed to amount to even 175 million, according to the International Energy Agency (IEA). That’s a technological and political task of mammoth proportions to be tackled similarly in numerous other countries as well.

Pole position for batteries

While originally two concepts were pitted against each other the rechargeable traction battery as the source for the propulsion power in the passenger car segment has currently prevailed against the hydrogen fuel cell. That’s reflected by both the vehicles being offered and the supporting infrastructure.

A paradigm shift in terms of perception and evaluation has occurred in this regard as well: While in the case of cars with internal combustion (IC) engines attention used to be focused on engine size and power output it’s directed almost exclusively at the traction battery in the case of electric cars – range and charging time are key criteria for purchasing decisions while the output of the electric motor installed in the vehicle is of secondary importance. Which emphasizes the fact that the traction battery is the most important component of an electric vehicle not only in terms of technology.

Top spot for the li-ion battery

Hundreds of thousands of traction batteries are by now in use and the type of the large-sized lithium-ion battery has long won out. For battery specialist Markus Hölzle from the Center for Solar Energy and Hydrogen Research Baden-Württemberg, it’s “a functional workhorse” because the use of lithium-ions as energy sources in various setups has been proven in practice and the related batteries can be produced in large numbers. In Hölzle’s view, the lithium-ion battery will continue to “become better and better and less and less costly, even after 30 years of development.”

“The performance indicators for energy density per kilogram or liter have doubled to tripled,” says Hölzle, without the end of the development having been reached yet. In fact, there’s a range of factors yet to be optimized before traction batteries will have reached their full technical potential. Around the world, battery developers, scientific research institutes, startups, automakers and battery producers, separately or in collaboration, are working at full stretch on optimizing the relevant parameters by changing the components, using different materials and modifying the battery architecture.

Saskia Wessel

„We’re currently perceiving that solid-state chemistry and sodium-ion chemistry are gaining in importance“

Attention is focused on these factors not only in the case of lithium-ion batteries but also with other battery storage technologies:

Capacity: The amount of electric energy that a traction battery can make available in relation to its weight is called gravimetric energy density. The unit of measurement for it is watthour per kilogram of battery weight (Wh/kg). For a high-end lithium-ion battery, it’s in the range of 250 Wh/kg. From this factor the question about range, which is central to potential buyers, automatically results: It depends on the capacity of the battery, the vehicle characteristics and the operating conditions. Like in the case of cars with IC engines, the rule applies that the heavier a vehicle and the faster it’s being driven, the higher its energy consumption – and the shorter the effective range of electric vehicles. In addition, outdoor temperatures play a role: range is reduced at low temperatures.

Charging speed: If a traction battery can be fully discharged or recharged within one hour it has a C-rate of 1. If it requires only half an hour, the rate is 2 C, in the case of a quarter of an hour it would be 4 C. The intensity of the charging current is important in this regard: a Tesla supercharger charges clearly faster than a wall box at home. Basically, the charging speed also depends on ambient temperatures and the battery.

Number of potential charging events: It’s deemed to be a parameter for the life of a battery. Currently, a battery is supposed to still have at least 70 percent of its original capacity after 10-year use and 1,000 full charging cycles. However, initial long-term experiences with this still young technology indicate lower aging losses, as current tests by TÜV Munich have confirmed.

Size and weight of the traction battery are decisive for its possible uses: In large, higher-powered vehicles, a large and thus heavy battery can easily be accommodated. In the case of smaller mid-size or compact cars, there’s currently only very limited space potential. That’s one of the reasons why a reduction of the content of passive materials by means of design changes is being pursued as the cell-to-pack architecture illustrates.

Price: Since electric motors are relatively small, can be produced in simple and cost-efficient ways and a complex powertrain is not required the traction battery is the most expensive component of an electric vehicle. If the costs of traction batteries can be cut significantly by using cheaper materials and optimized manufacturing methods their potential uses will automatically grow because lower-priced vehicles can be electrified as well.

Aspects of the manufacturing method and ecology play a major role in the production of traction batteries too. The fewer critical raw materials – whose exploration, mining and transportation entails an environmental burden – are needed for a battery, the better a battery factory’s potential for future-proof and autonomous production. Awareness of the dependency on just a few supplying countries as well as sustainability aspects have boosted the search for substitute materials.

Other traction battery parameters to be optimized are temperature dependence of the internal chemical process (especially charging behavior at freezing temperatures), self-discharging, combustibility in the event of mechanical damage or short-circuiting within the battery cells and aging.

Dynamic innovations

Unexpected momentum sometimes occurs while technical details of lithium-ion batteries are being optimized and new production sites planned: In spring of 2023, the Chinese company CATL presented the spectacular innovation of a sodium-ion battery that was immediately installed in Chinese electric vehicles. Although the sodium-ion battery has a similar design as the lithium-ion battery it uses sodium, to which it owes its name, as the charge carrier. Markus Hölzle views this as a fundamental advantage: “In the best case, the sodium-ion battery contains no critical metals or only very small amounts of them. That clearly improves the carbon – or environmental – footprint.”

That the design of sodium-ion batteries is nearly identical to that of lithium-ion batteries enabling them to be produced on existing manufacturing lines is another advantage. Due to a clever composition of the electrolyte, it delivers better performance at temperatures below zero than a lithium-ion battery and has shorter charging times. Several major automakers in China as well as in Europe and the United States are going to install sodium-ion batteries as soon as possible. Plus, because they can be produced at significantly lower costs, these types of batteries are particularly suitable for the electrification of smaller, cheaper car models that’s only picking up moderate momentum. In that segment, the currently biggest disadvantage of sodium-ion batteries carries less weight: The gravimetric energy density of a sodium-ion battery of 160 watthours per kilogram is still below that of a conventional lithium-ion battery. But CATL has already announced 200 Wh/kg for the second generation of its new battery.

In addition, CATL, in August, shot a second arrow from its development quiver in the direction of the market that caused a major sensation: an ultrafast-charging lithium-ion-phosphate battery (LFP) called Shenxing. It’s supposed to enable charging in ten minutes for 400 kilometers (249 miles). For comparison: Tesla for the Model 3 states that the battery can be charged for range of up to 275 kilometers (171 miles) in 15 minutes.

This evolutionary leap was primarily enabled by nano-crystallizing cathode material and the utilization of so-called second-generation ring technology on the graphite anode. Those measures enabled the lithium-ions to be extracted faster and – for better range – to be deposited in larger numbers. CATL is planning to launch mass production of the new lithium-ion-phosphate cell before the end of this year and start deliveries in the first quarter of 2024.

Battery knowledge: From A as in anode to C as in cell

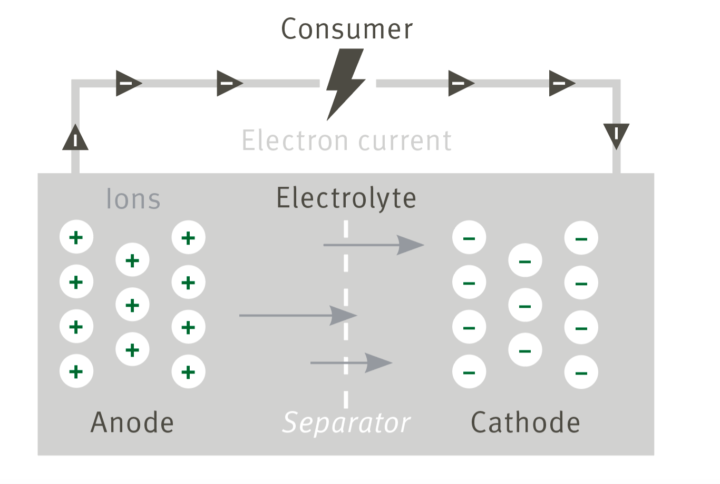

How batteries work: Each battery cell consists of four basic elements: two differently charged electrodes (graphite and mixed oxide electrode) and a typically liquid or gel-like electrolyte in which ions (charged atoms such as lithium atoms) can move. The fourth element is a separator that’s permeable for the ion flow between the two electrodes. It protects against short circuits. During the discharge stage, i.e., when the battery is in use, a chemical oxidation process is started. This process releases electrons on the grid structure of the graphite electrode that, like the ions, want to move to the other mixed oxide electrode in order to restore the voltage balance that was upset during the charge stage. However, in contrast to the ions, the electrons cannot directly pass through the separator but must get to the other side by using a bypass. Located between this bypass is an electrical consumer that is supplied with electrical energy by the electron flow. In the case of an electric vehicle, it’s the motor. Once ions and electrons have been recombined at the mixed oxide electrode the current flow stops. During the charging stage another oxidation process is activated but in the opposite direction. That’s why rechargeable batteries are also referred to as redox storage systems. During the operation of an electric vehicle this process can constantly change directions: During acceleration the battery is discharged and during braking events it’s charged by recovering (recuperating) energy. During that process the anode and cathode’s roles change as well: During the discharge stage the negative electrode works as the anode and the positive electrode as the cathode. During the charging stage the anode becomes positive and the cathode negative.

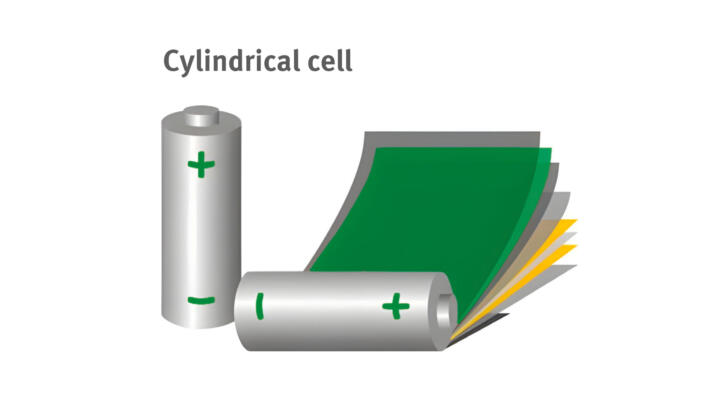

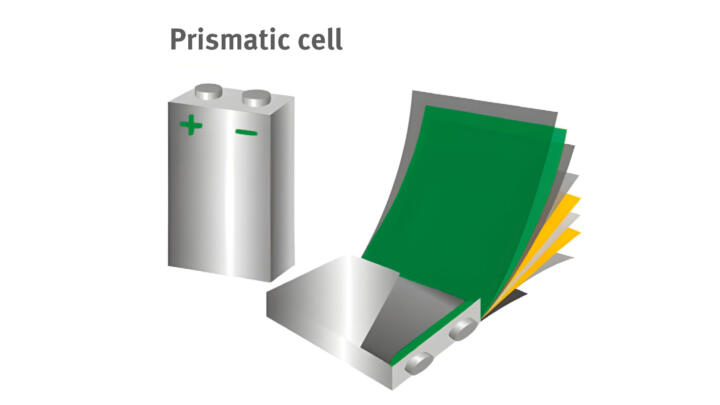

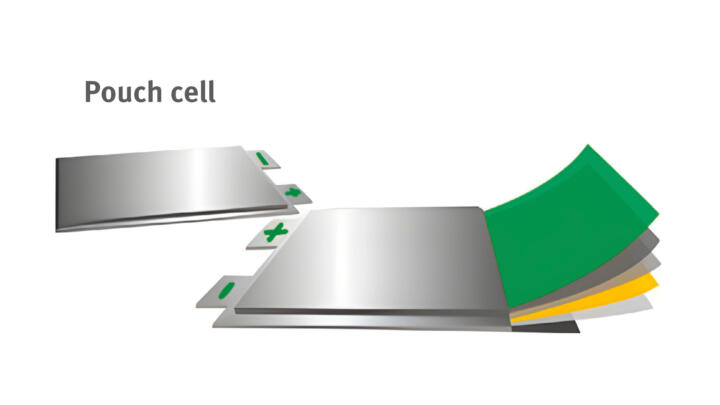

Battery cell There are different types of cells that are named according to their shape or design. Due to a variety of strengths and weaknesses, no design has won out yet:

Cells, modules & packs: Currently, the serial arrangement of individual battery cells and combination into modules with separate housings, which simplifies assembly, is common practice. Several modules then form the battery. However, that implies a substantial amount of passive material, i.e., for housings, supporting elements, etc. To increase the share of active material in total weight and volume, the pack architecture is changed so that a larger number of battery cells can be linked directly and accommodated in the battery housing. This design is called cell-to-pack (CTP).

Direct packaging: Battery cells that are directly installed in the chassis – where the chassis then provides a protective function for the battery elements – are referred to as cell-to-body (CTB), cell-to-chassis (CTC) or cell-to-vehicle (CTV) designs. When highly integrative systems like these are optimized the functions of the vehicle components are fused with each other by battery cells assuming structural roles and chassis elements performing thermal roles as part of energy storage. Other benefits include a reduction in the number of components and more efficient space utilization in the vehicle. Repairs and recycling, though, are more than likely a lot more difficult.

Solid-state as up-and-coming battery type?

“In addition to the further development of the lithium-ion cell, we’re currently perceiving that solid-state chemistry and sodium-ion chemistry are gaining in importance,” says Saskia Wessel. As Head of Division at the Fraunhofer Research Institution for Battery Cell Production FFB, she observes the developments with great expertise. The media keep reporting about the solid-state miracle battery, in other words a battery that works without liquid or gel-like electrolytes, as well.

In fact, there are promising prospects for traction batteries operating with solid-state electrolytes such as porous ceramics. Their clearly larger capacity is enabled by an increase in cathode material, among other things. Lithium, which is efficient due to its high binding activity, can be used as the anode and, due to the absence of an inflammable electrolyte, safety aspects will be another trump card. Volkswagen, together with its development partner QuantumScape, is planning to launch a solid-state battery by 2025. VW’s Head of Battery Cell and System Frank Blume considers a 30-percent increase in range and 50-percent reduction of charging time by the new technology to be possible.

Under the name of lithium-polymer battery, Mercedes-Benz has already introduced a solid-state system in the production of the eCitaro public bus. However, to be conductive for the ions, the polymer that’s being used as the solid material here first needs to be preheated to 70 to 80 degrees C (158 to 176 degrees F). That’s a disadvantage which can be mitigated in scheduled service but not necessarily in everyday use of a passenger car. So much for the technical aspects.

“The solid-state cell entails a disruptive production process requiring significant investments in machine technology,” says Saskia Wessel, emphasizing a key aspect. For mass production runs, completely new battery factories would have to be built with capital expenditures in the range of billions – costs that will also be reflected in vehicle prices. Even so, Toyota has already announced vehicles with solid-state batteries.

Extended uses

In the short rather than the medium run, traction batteries are going to be used in areas other than passenger cars as well. The more powerful they are, the more electricity they can provide despite low weight, the more attractive they’ll become for use in trucks, boats and even in aircraft.

In transportation, a wider rollout of electrification is just around the corner. The portfolio of the Swiss company Designwerk based in Winterthur – a member of the Volvo Group – includes traction batteries installed behind the driver’s cabin on the tractors of semi-trailer trucks or under the floor of trucks, now enabling daily mileage of up to 1,000 kilometers (621 miles). “The subject of range no longer is as central as it used to be a few years ago,” says Product Manager, Battery Systems Thomas Prohaska, with reference to a significant improvement of the battery parameters: “From 2016 to 2023, the energy density of our batteries increased by 85 percent.” Now, questions of weight are of central importance regarding the electrification of road transportation. The full equipment of a Designwerk truck with four batteries of 257 kWh each means 5.6 metric tons (6.1 short tons) of additional weight, which Prohaska puts in perspective, though: “Due to the elimination of diesel engines and fuel tanks, curb weight decreases,” plus, he adds that in Switzerland and in the EU two metric tons (2.2 short tons) more of gross vehicle weight are allowed for electric vehicles. The greater length of the semi-trailer trucks necessitated by the battery packs is planned to be legalized as well.

But how practical are electric trucks with lithium-ion batteries? Prohaska views the limiting factor not in battery capacity but in the issue of charging options. Competitor MAN is planning to launch a fully electric truck in 2024 that’s supposed to achieve range levels of 500 kilometers (310 miles). With adequate charging network coverage, says MAN, the prescribed rest periods of the driver could be used for recharging. 1,000 kilometers (620 miles) per day could soon be achieved by battery-electric power in that way.

Highly dynamic market segment

When so many players are active in a promising market (promising in this case meaning a market with very large business potential) it’s only logical that one innovation chases the next one and news are announced almost on a daily basis. Together with partners, BASF launches the production of cathode materials in Schwarzheide and concurrently starts operating a recycling center for traction batteries. Swiss Clean Battery announces the construction of a factory for solid-state batteries. Saaku – a manufacturer focused on 3D-printed solid-state batteries – is planning the construction of several gigafactories worldwide together with Porsche Consulting. Stellantis reports the market launch of electric vehicles delivering significantly improved range. Initial prototypes of lithium-air batteries with triple energy density work on laboratory scale, Nio’s SUV EL6 is supposed to achieve a range of more than 900 kilometers (559 miles) with a semi-solid-state battery. A consortium around Schaeffler’s partner ABT is developing a battery that delivers alternating current and no longer needs an inverter. That stretches range as well. And news from South Korea says that a silicon-based polymer binding agent of a newly developed anode is supposed to enable a tenfold increase in range. Et cetera, et cetera.

Albeit, much of this is still in the planning and announcement stages. Only the actual market development will show which system and which solution will ultimately be successful and set the new standards. The reason is that it’s not the best solution that’s going to prevail but that the strongest company is going to push through its solution because, once it’s been made, the decision for a particular capital expenditure (for building a factory) has set the course. Markus Hölzle confirms that “industry sets the pace of developments.”

So, it’s not finally clear in which direction traction batteries are headed because, on the one hand, new solutions can be expected in view of the high development intensity: “Predictions continue to be difficult,” says Markus Hölzle, assessing the situation, “because the market keeps producing surprises – and always in a positive direction. There’s truly a lot going on and things are going to happen that today we still feel are impossible.” That’s what the market launch of the sodium-ion battery by CATL that was surprisingly fast even for experts impressively showed.

On the other hand, it’s often external factors that help make a solution successful. Whether or not the fire on the car freighter Freemantle Highway in July 2023 was caused by a traction battery the damage to the ship attracted attention to the fire potential of lithium-ion batteries with liquid electrolytes. Discussions like these could additionally accelerate the development of solid-state batteries. Yet no matter what, the future lies between the anode and the cathode.

Schaeffler in battery manufacturing

Schaeffler not only has electric drive system capabilities – for the internationally growing traction battery market, the Schaeffler Group’s Special Machinery engineering department has become a sought-after company to turn to. “We have already been successful in implementing projects for external customers within e-mobility for the internationally growing battery market,” says Bernd Wollenick, SVP Schaeffler Special Machinery. The range includes system concepts used in module assembly for all customary battery cell formats, which can be scaled to various output rates. Schaeffler Special Machinery can provide an agile and rapid response here, delivering turnkey solutions with simultaneous engineering to customer standards with short lead times. Ten customer-specific systems have been developed for automobile manufacturers and automotive suppliers to date, for use in isolating prismatic cells. Highlights include the combination of highly dynamic robots and transfer systems with direct drives, the integration of laser structuring and plasma activation as well as the high-voltage testing of the entire battery cell surface following paint application.